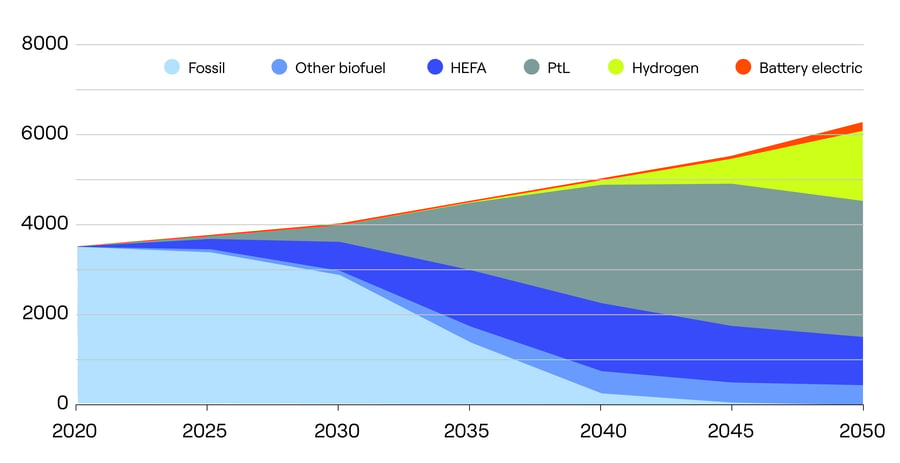

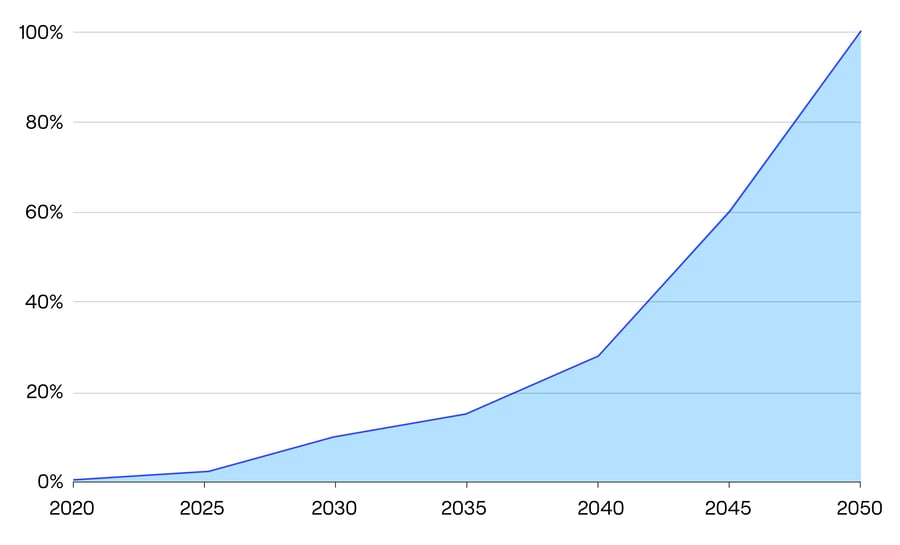

The EU and USA take different approaches to developing the SAF economy – although many experts expect these approaches to converge with time. Simply put, Europe’s ReFuelEU mandates steadily increasing blends of SAF for flights originating in the EU; the USA incentivizes with specific sums payable per gallon of low-carbon fuel produced. These two graphs show the expected course of mandates and incentives for the two regions, based on current understanding of legal roadmaps.

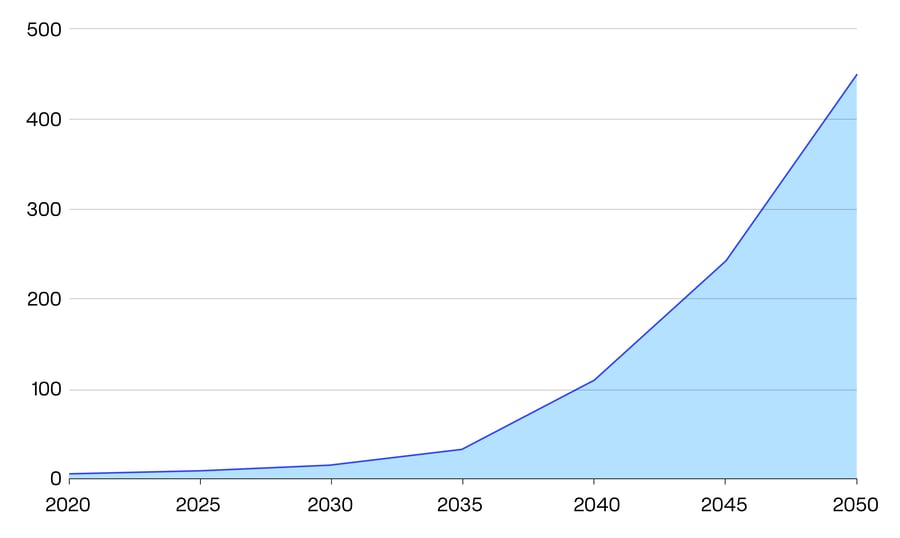

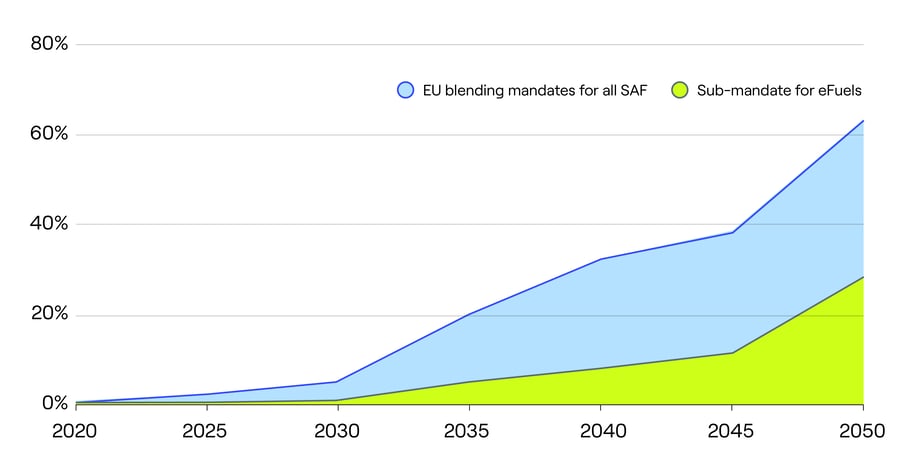

Chart: EU blending mandates for all SAF and sub-mandate for eFuels

Note that in July 2022, MEPs voted for more ambitious targets of 85% by 2050; this vote has not (yet) been ratified. In addition, other proposals require aircraft taking off from EU airports to take 90% of their fuel load from that airport – discouraging “fuel tankering”, or the practice of carrying more fuel than needed on route segments to reduce the need to refuel where costs are high33.

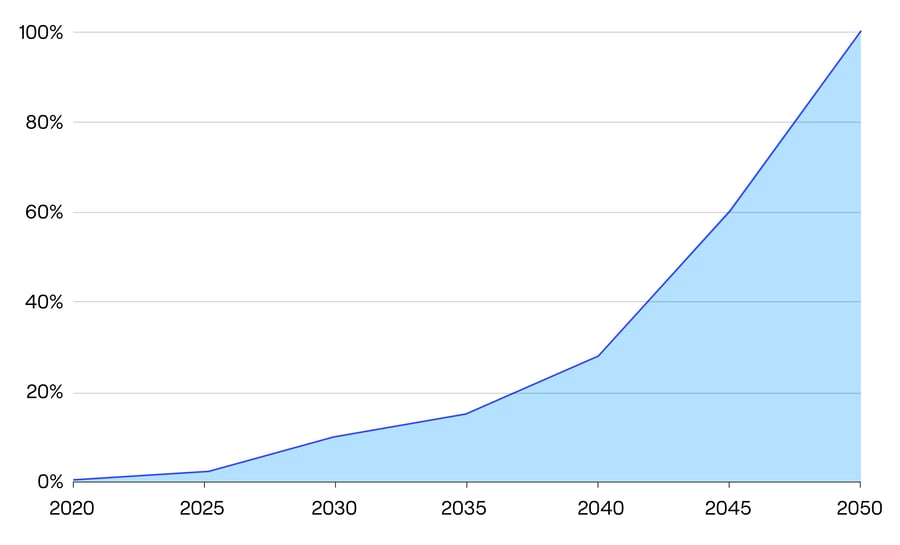

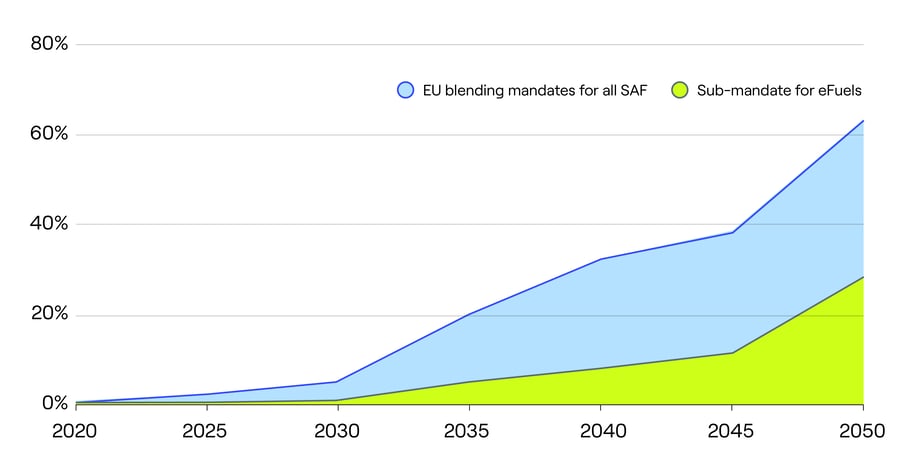

Chart: Incentivized USA targets for SAF use by US airlines (note % of use not % of blend)

The USA’s SAF Grand Challenge is a production target that aims to answer demand, rather than a mandated usage target. Through 2025 USA legislation allows for a USD 1.25-1.75 subsidy per gallon of SAF, with a plan to achieve a 50% decrease in lifecycle GHGs. This supports a goal of producing 3bn gallons of SAF per year by 2030 on the way to ensuring SAF supplies for 100% of aviation fuel demand by 205034.