The global climate consensus stage has passed, and the target-setting is completed.

Now is the time to consider next steps and that's where blue hydrogen (also commonly known as 'low-carbon hydrogen') come in. Let’s implement ultra-low carbon hydrogen and let’s use natural gas resources to do that. Because — make no mistake — natural gas has a huge role to play in reaching a low-carbon world.

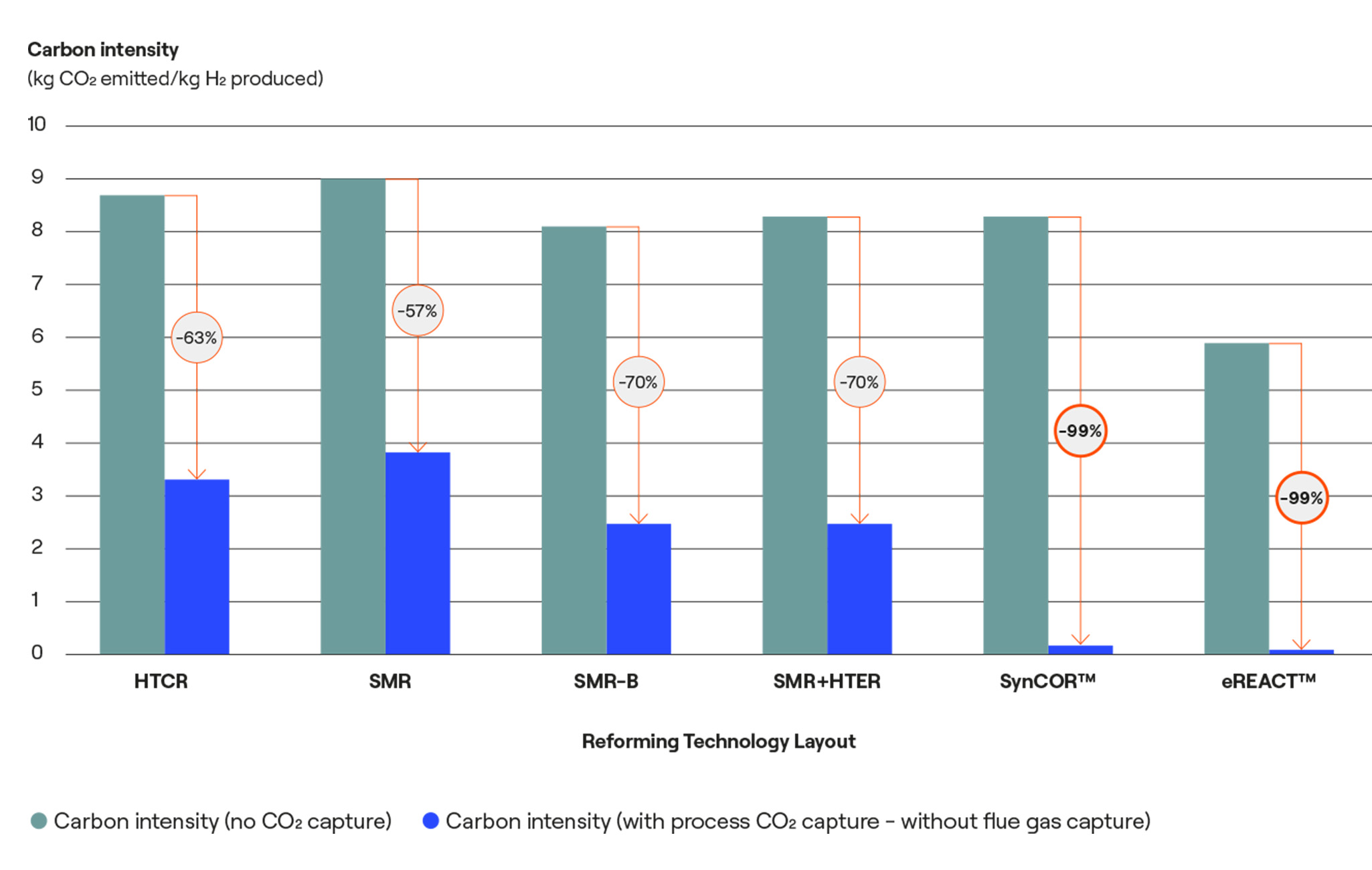

.png)